Child Tax Credit 2024 Phase Out – If you have a child — even one that was born in 2023 — you may be eligible for the child tax credit. If you qualify, the credit could reduce how much you owe on your taxes. As of right now, only a . With the 2024 tax season starting tomorrow, you might be looking for any tax credits you’re eligible for. While you probably already know whether you’re eligible for the federal child tax credit of up .

Child Tax Credit 2024 Phase Out

Source : itep.org

Here Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

The American Families Plan: Too many tax credits for children

Source : www.brookings.edu

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Build Your Own Child Tax Credit 2.0 | Committee for a Responsible

Source : www.crfb.org

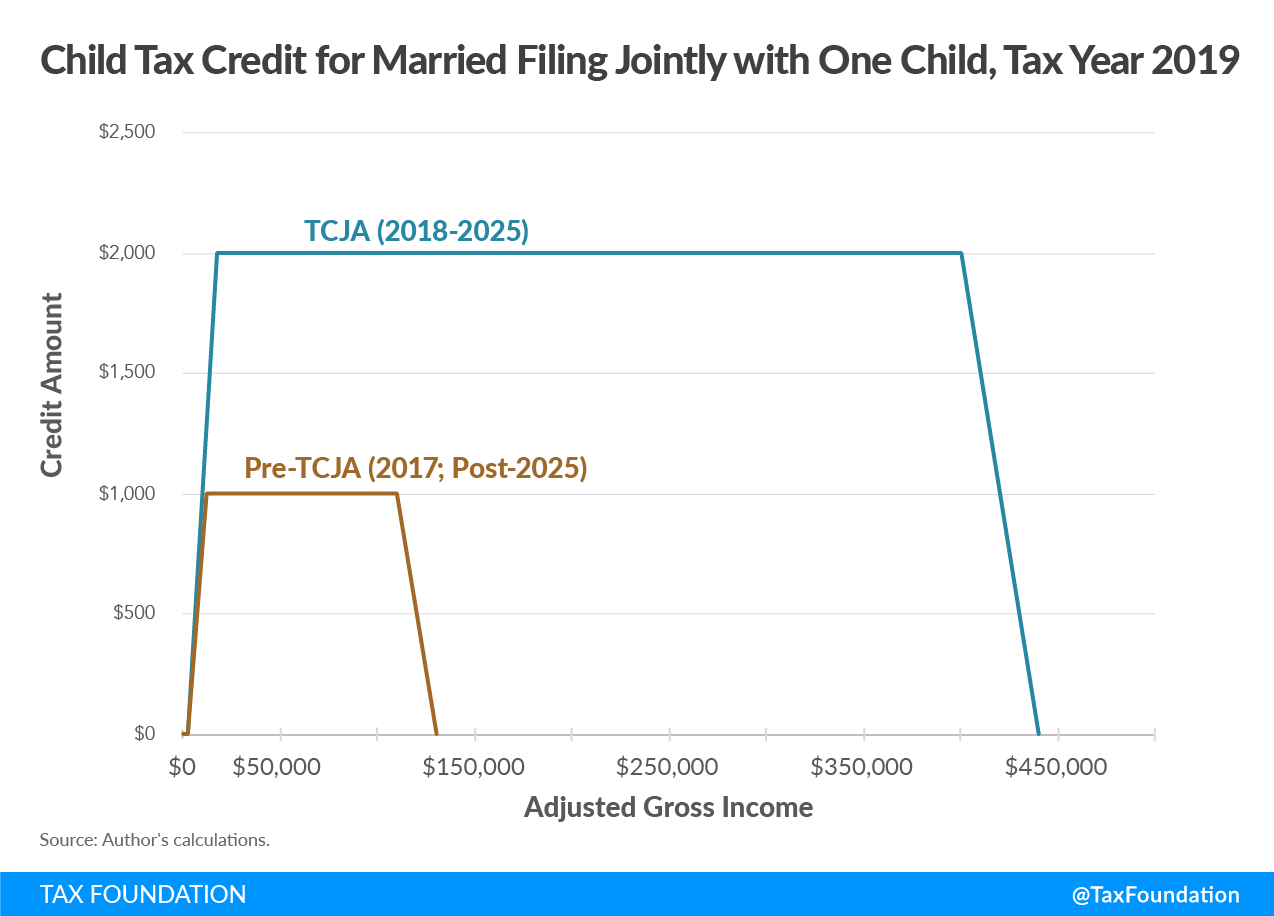

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

Child Tax Credit 2024: Eligibility Criteria, Apply Online, Monthly

Source : ncblpc.org

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Child Tax Credit 2024 Phase Out States are Boosting Economic Security with Child Tax Credits in : Income thresholds also come into play, causing the credit to phase out for higher earners is slated to increase to $1,800 for 2023, $1,900 for 2024, and $2,000 for 2025. The overall child tax . Here’s how a proposed change in the rules for the child tax credit impact tax refunds and the upcoming tax season. .